dependent care fsa eligible expenses

CHILD CARE EXPENSE ELIGIBLE. Child Dependent Care Eligible Expenses Here is a list of the most common dependent care expenses.

Your Flexible Spending Account Fsa Guide

Learn more about the benefits of a dependent care FSA with PayFlex.

. Below are the basic rules followed by our interpretation as they relate to standard service providers. A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent. Piano lessons for children Preschool.

Nanny and Babysitter Pre-K or Nursery school Before-or after-school care Daycare for disabled adult or child. Dependent care FSA-eligible expenses include. Na 5000 Net pay 38674 37541.

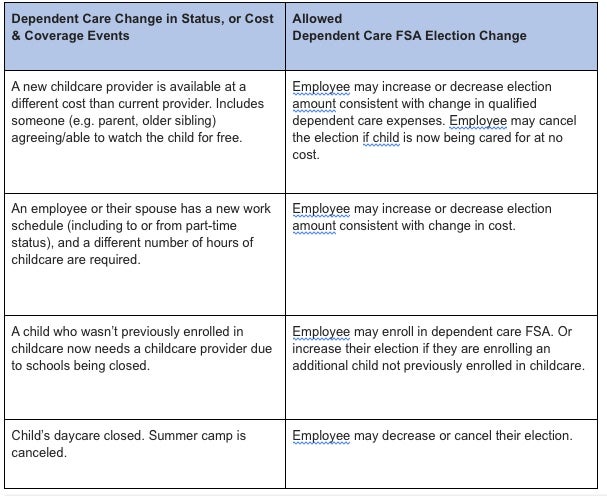

Its a smart simple way to save money while taking care of your loved ones so that you can continue to work. The employee incurs 7000 in dependent care expenses during the period from january 1 2022 through june 30 2022 and is reimbursed 7000 by the dc fsa. Private school tuition for kindergarten and up Registration fees required for eligible child care after actual services are received.

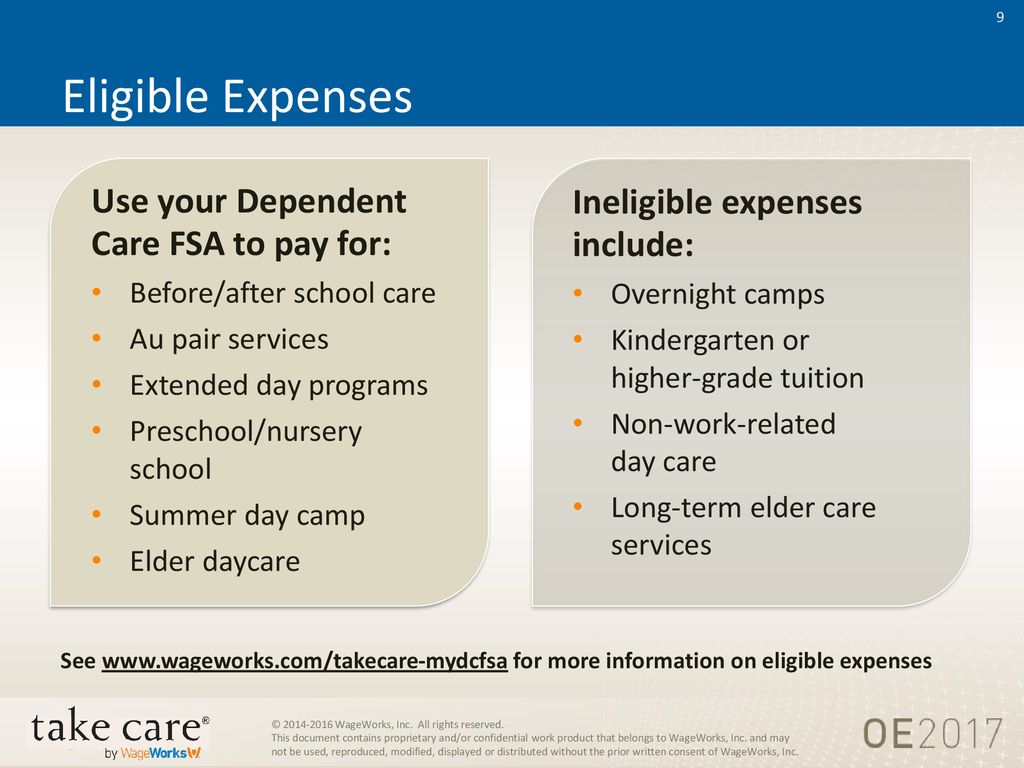

The following lists are not all-inclusive. The Internal Revenue Service IRS decides which expenses can be paid from an FSA and they can modify the list at any time. Summer camps for dependent children under age 13.

Dependent Care Fsa Limit 2022. If you exclude or deduct dependent care benefits pro- vided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 3000 Schedule H Form 1040 W-10 Page 2 Publication 503 2020 httpswwwirsgovformcomments. Payroll taxes related to eligible care.

Dependent Care FSA Eligible Expenses. Medical care for children or dependent adults Nanny for children Nursery school. Your children under age 13.

Your spouse attends school full time. Licensed day care centers. This document can be used to help you determine which expenses may be eligible for reimbursement under your Health Care or Dependent Care Flexible Spending Account FSA.

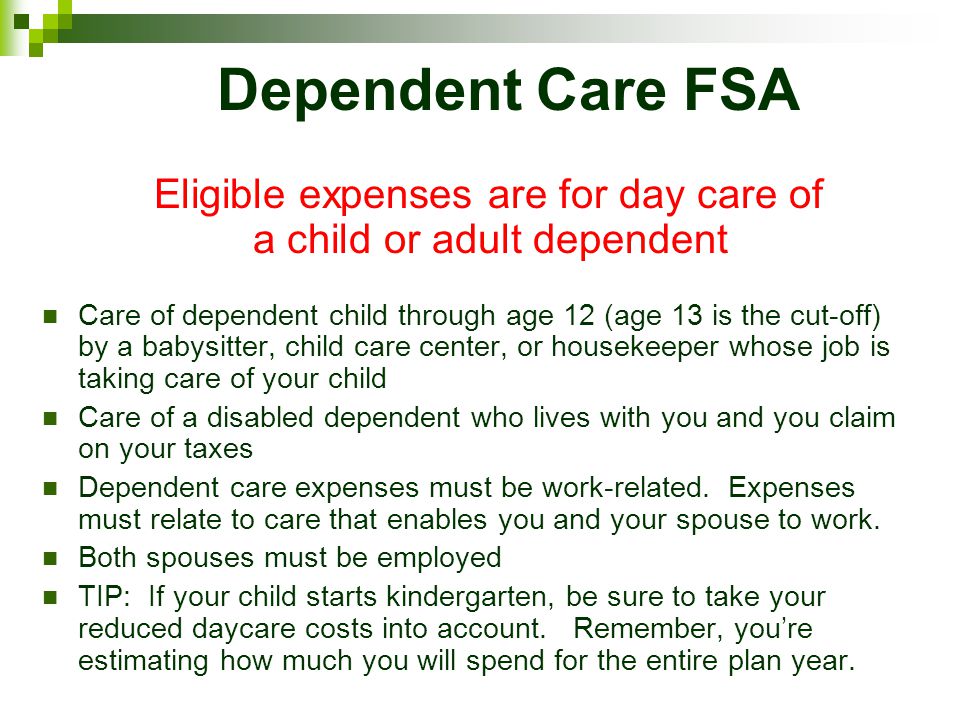

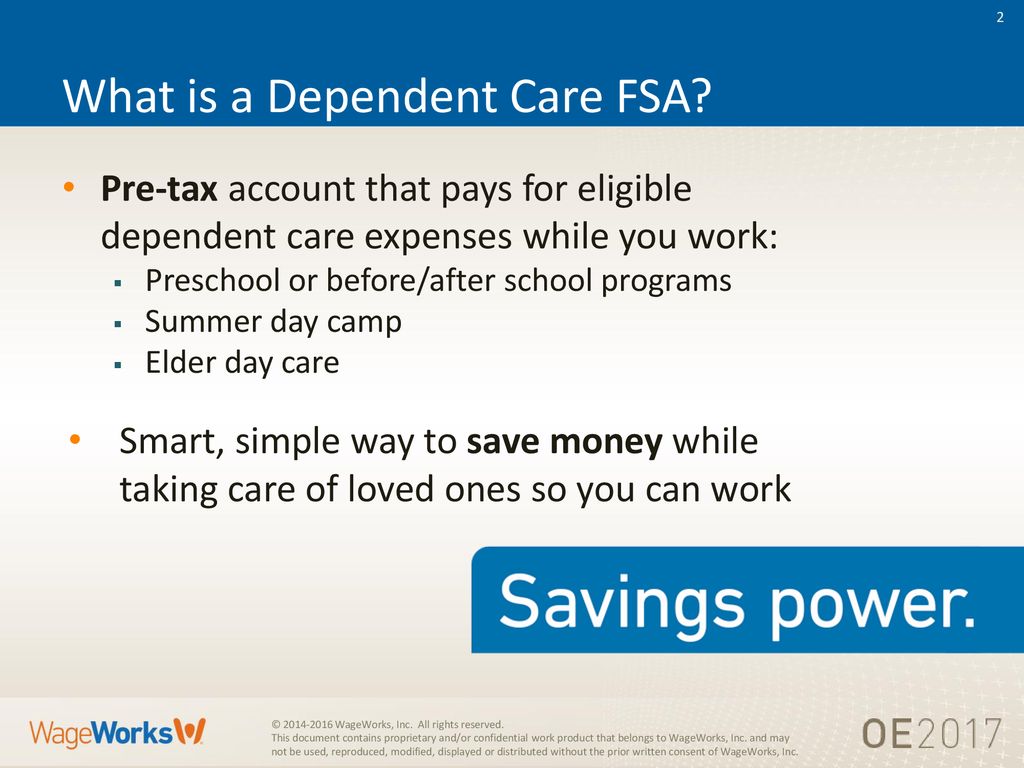

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare. Before school or after school care other than tuition Qualifying custodial care for dependent adults. While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 8000 if you had one qualifying person or 16000 if. Adult day care facilities. Private school tuition for kindergarten and up Registration fees required for eligible care after actual services are received.

The expenses must enable you and your spouse to work or look for a. The Savings Power of This FSA. Nursing home care for dependent adults Payroll taxes related to eligible dependent care.

For purposes of Dependent Care FSA your eligible dependents are. Transportation to and from eligible care provided by. 5000 na Taxable income.

Activity Fees Piano Lessons Dance Class Au pair. Preschoolnursery school for pre-kindergarten. Every family situation is different so we recommend consulting with a tax advisor if your specific expense does not fit into one of these categories.

Nursery schools or pre-schools. Elder care form parent or dependent. Download a list of dependent care expenses by clicking here.

Cover expenses for your childdependent. 55000 55000 Pretax dependent care expenses. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than others hope.

You can use your Kazdon Dependent Care FSA to pay for a huge variety of child and elder care services. To qualify as an eligible expense the babysitters services must allow you. Registration fees required for eligible care after actual services are received Sick-child care center.

The IRS determines which expenses are eligible for reimbursement. Must be necessary in order to work Applies to spouse For dependents age 13 and under Qualified Health. This account can be used for eligible daycare expenses for your eligible dependents if.

If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or look for work. Piano lessons for children Preschool. Both you and your spouse work.

With dependent care FSA Without dependent care FSA Allison and Michaels income. A dependent care FSA helps you pay for eligible child or adult day care expenses. Qualified Dependent Care Expenses for your FSA Account.

An exception may apply when the spouse is a full-time student or incapable of self-care. 7501 8251 FICA Social Security and Medicare. 50000 55000 Estimated federal income taxes.

Expenses are generally only considered eligible for reimbursement under the Dependent Care Flexible Spending Account when the expense enables the employee and spouse if applicable to be gainfully employed or seek employment. Medical care for children or dependent adults Nanny for children Nursery school. Nursing home care for dependent adults Payroll taxes related to eligible dependent care.

The IRS has outlined a list of Dependent Care FSA eligible expenses. Arpa increased the dependent care fsa limit to 10500 for calendar year 2021. 3825 4208 Post-tax dependent care expenses.

You are a single parent. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including preschool nursery school day care before and after school care and summer day camp. Qualified dependent care expenses Au pair services Babysitting services Before- and after-school programs Custodial or eldercare expenses in-home or daycare center not medical care Nursery school Pre-kindergarten Summer day camp not educational in nature Ineligible dependent care expenses Clothing Foodmeals.

These include day care before- and after-school programs nursery school or. Placement fees for a dependent care provider such as an au pair.

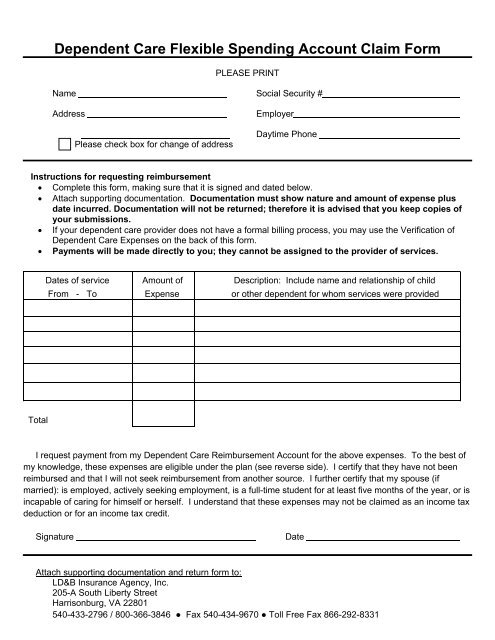

Dependent Care Flexible Spending Account Claim Form

How A Dependent Care Fsa Can Enhance Your Benefits Package

2016 Flexible Spending Account Information

Flexible Spending Accounts Ppt Video Online Download

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

File A Dca Claim American Fidelity

2021 Wake Forest Benefits Guidebook By Wfu Talent Issuu

How To File A Dependent Care Fsa Claim 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Flexible Spending Account Ppt Download

Dependent Care Fsa Flexible Spending Account Ppt Download

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group